IRS W-10 2020-2025 free printable template

Show details

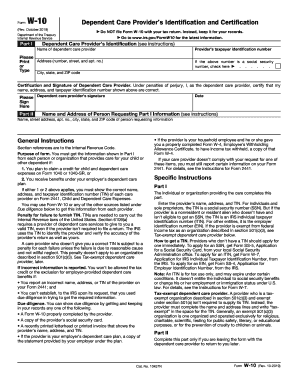

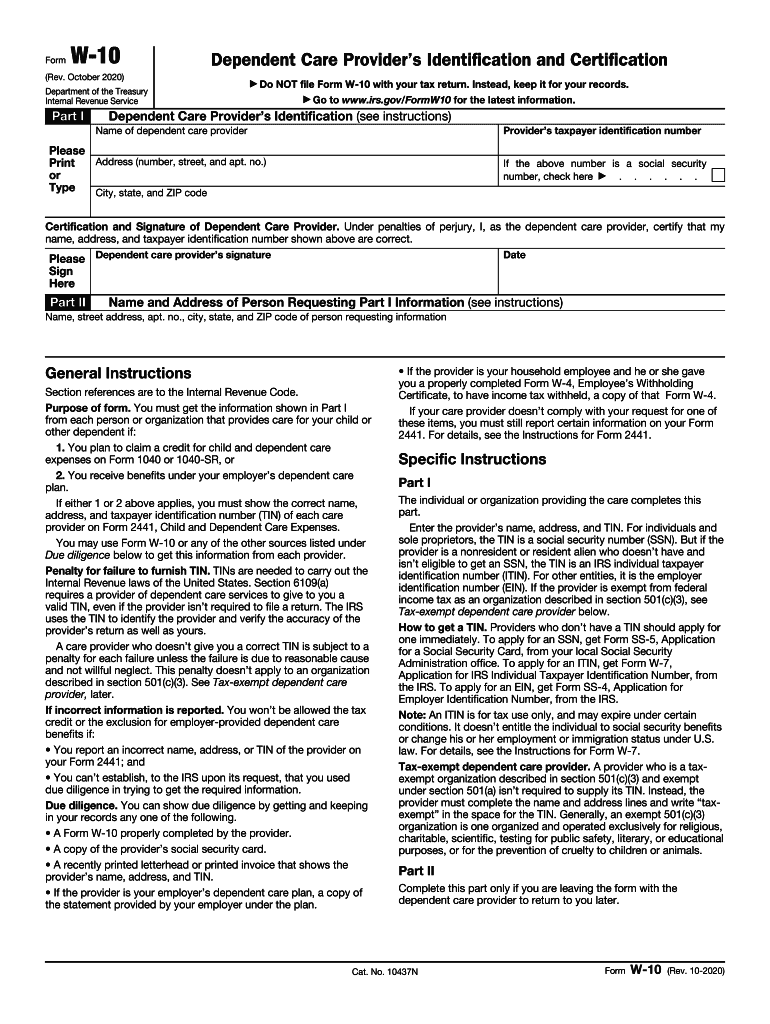

Form W-10 Dependent Care Provider s Identification and Certification Rev. October 2016 Department of the Treasury Internal Revenue Service Part I Do NOT file Form W-10 with your tax return. Instead keep it for your records. You may use Form W-10 or any of the other sources listed under Due diligence below to get this information from each provider. You can show due diligence by getting and keeping in your records any one of the following. A Form W-10 properly completed by the provider. About...

pdfFiller is not affiliated with IRS

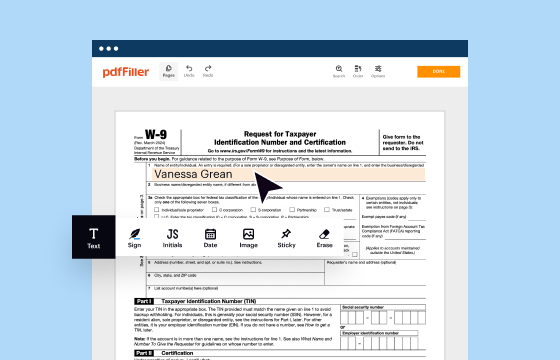

Understanding the IRS W-10 Form: A Comprehensive Overview

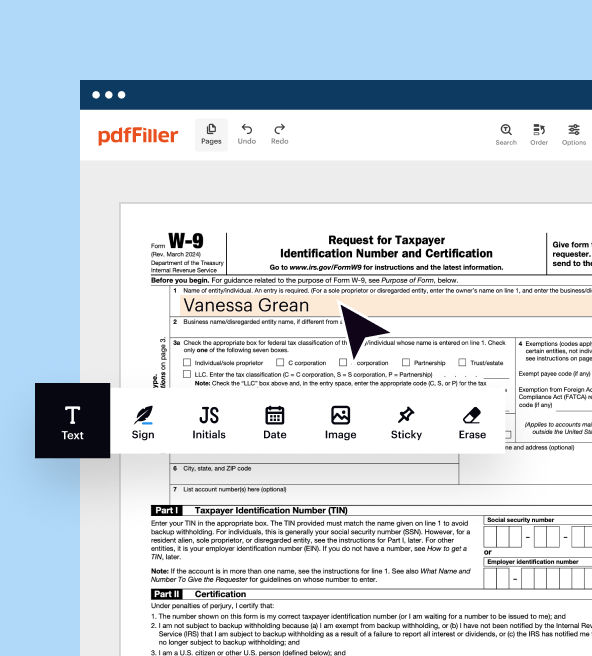

Clear Steps to Modify the IRS W-10

How to Accurately Complete the IRS W-10

Understanding the IRS W-10 Form: A Comprehensive Overview

The IRS W-10 form, officially known as "Dependent Care Provider’s Taxpayer Identification Number," plays a crucial role in ensuring tax compliance for those at a parent’s service. This form helps facilitate the identification and reporting requirements needed to claim tax credits related to dependent care expenses. Gaining a clear understanding of the W-10 not only ensures compliance but also maximizes potential tax benefits.

Clear Steps to Modify the IRS W-10

When it comes to editing the IRS W-10 form, follow these clear steps to guarantee accuracy:

01

Review the existing entries on your form to ensure that all information is current and correct.

02

Cross-check the Taxpayer Identification Number (TIN) and ensure it matches the IRS records.

03

Update any personal information such as name, address, or phone number if changes have occurred.

04

Verify the signature and date to ensure that the document is fully endorsed before submission.

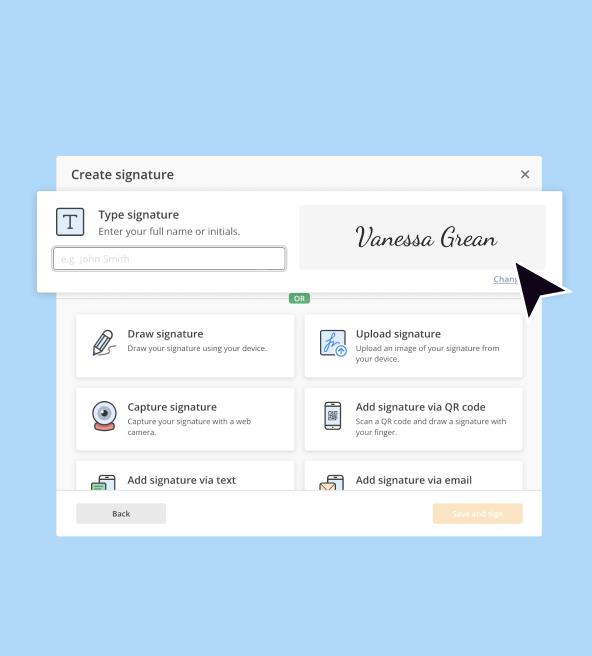

How to Accurately Complete the IRS W-10

Filling out the IRS W-10 form requires meticulous attention to detail. Here’s how to complete it:

01

Start by listing your name as the caregiver, along with your TIN, which is usually your Social Security number.

02

Provide your complete address, ensuring it's current and free from errors.

03

Indicate your tax classification: Individual, Corporation, Partnership, etc.

04

Sign and date the form to confirm that all the information is accurate and submitted willingly.

Show more

Show less

Recent Updates to the IRS W-10 Form

Recent Updates to the IRS W-10 Form

The IRS continuously updates forms to reflect changes in tax laws and practices. Notable recent changes to the IRS W-10 include:

01

Introduction of new requirements for verifying provider TINs to enhance integrity and prevent fraud.

02

Adjustment of guidelines regarding exemption qualifications, which now specify income thresholds.

Essential Insights into the IRS W-10 Form

What is the IRS W-10?

Purpose of the IRS W-10 Form

Who Needs to Complete the IRS W-10?

Exemption Criteria for IRS W-10

Penalties for Non-Compliance with the IRS W-10

Information Required for Filing the IRS W-10

Submission Address for IRS W-10

Essential Insights into the IRS W-10 Form

What is the IRS W-10?

The IRS W-10 is a declaration form through which dependent care providers provide their TIN to clients. This form aids in claiming tax credits available for care expenses incurred for dependents, streamlining the reporting process for both clients and the IRS.

Purpose of the IRS W-10 Form

The primary purpose of the IRS W-10 is to formalize the identification of dependent care providers. This enables parents or guardians to document payments for services rendered, thus ensuring they can legitimately claim tax benefits associated with child care expenses when they file their taxes.

Who Needs to Complete the IRS W-10?

Any caregiver offering dependent care services with the intention of the client claiming tax credits must provide the W-10. This includes nannies, babysitters, and daycare facilities. It is particularly necessary for those operating as independent contractors.

Exemption Criteria for IRS W-10

Exemptions regarding the information required in the IRS W-10 apply under specific circumstances. Common qualifying conditions include:

01

Income under a specified threshold, limiting the need for TIN reporting.

02

Care providers operating under certain nonprofit organizations.

03

Specific types of transactions, such as non-monetary exchanges for services.

Penalties for Non-Compliance with the IRS W-10

Failing to submit or inaccurately completing the IRS W-10 can lead to serious repercussions, such as:

01

Financial penalties ranging from $50 to $550 per violation, depending on severity.

02

Potential withholding of future tax credits until compliance is established.

03

Legal consequences if intentional fraud is detected.

Information Required for Filing the IRS W-10

To properly file the IRS W-10 form, the following essential information is required:

01

Caregiver's full legal name.

02

Taxpayer Identification Number (TIN), typically a Social Security number.

03

Complete address where services are rendered.

04

Type of tax classification under which the caregiver operates.

Submission Address for IRS W-10

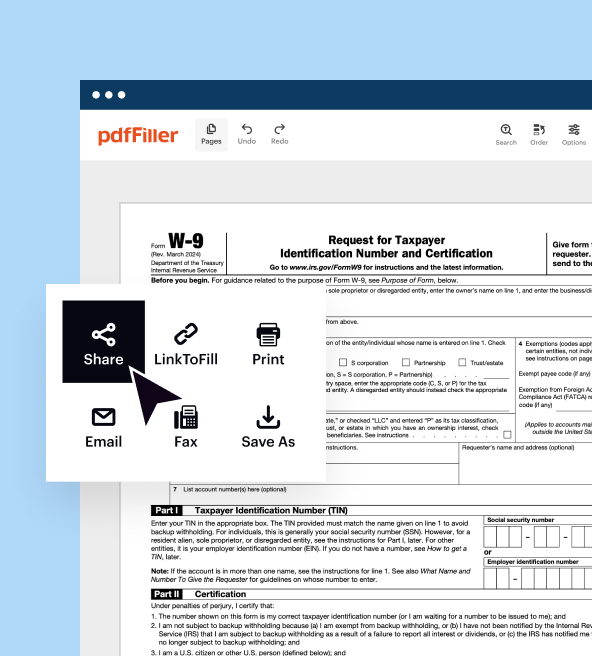

The completed IRS W-10 form should be submitted directly to the client requesting the tax identification number. There is no need to send this particular form to the IRS, although the client must retain it for their records.

Understanding the complexities of the IRS W-10 form helps both caregivers and clients navigate potential tax benefits efficiently. By ensuring you have all the information required and adhering to the outlined protocols, you can mitigate risks associated with non-compliance. For those needing assistance with filling out the form or understanding related tax implications, consider reaching out to a tax professional or using resources like pdfFiller to streamline the process.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.